Why We Built the Profit Edge Tax Advisory Service

Most small business owners don’t overpay taxes because they’re careless — they overpay because no one’s helping them plan ahead. Tax advisory is not on their radar or priority list. JC Tax Services solves this issue for its clients.

Tax filing is backward-looking.

Tax planning is forward-thinking.

The Profit Edge Tax Advisory helps you stop reacting to taxes and start managing them with structure and confidence.

Strategic Tax Planning

Receive personalized tax reviews and blueprints that maximize savings and align with your business goals for ongoing success.

Transparent Pricing and Processes

Benefit from clear, affordable pricing and straightforward advisory steps that make tax management simple and stress-free.

Expert Year-Round Support

Enjoy continuous guidance throughout the year to streamline bookkeeping and proactively manage your tax obligations.

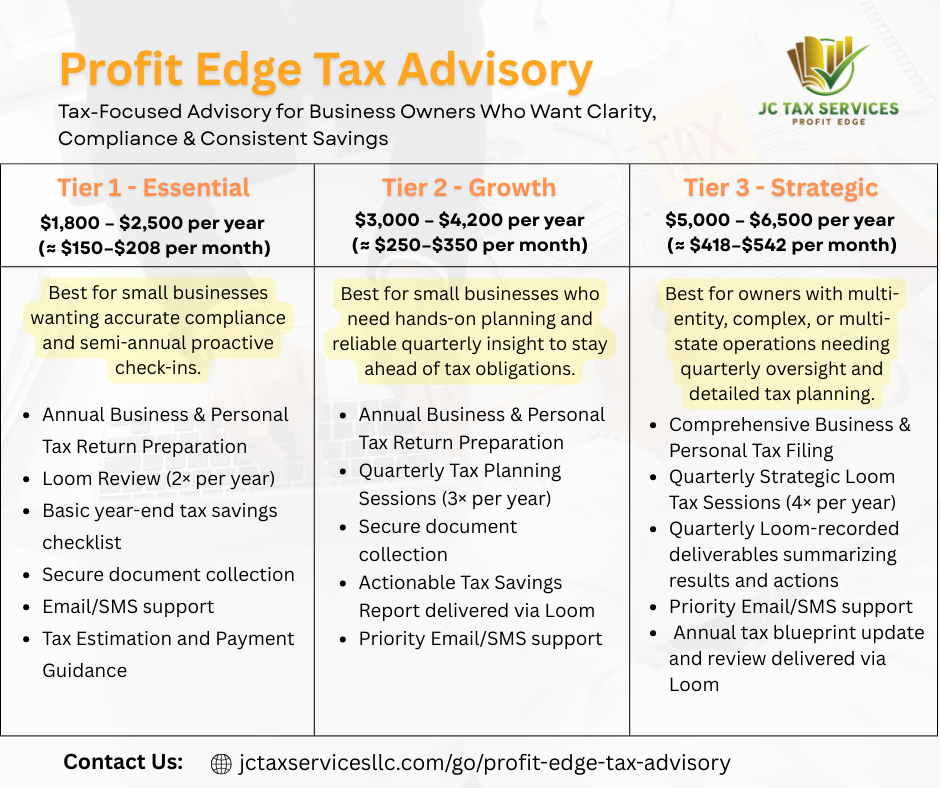

The Profit Edge Tax Advisory Tiers

Explore how our strategic tax planning and expert guidance help small business owners maximize savings and simplify bookkeeping all year round.

Tier 1 – Essential Advisory

• Semiannual business financial and tax review

• Personal and business return preparation

• Tax estimation and payment guidance

• IRS correspondence support

Tier 2 – Growth Advisory

• Quarterly tax strategy and projection reviews

• Business and personal tax filing

• Mid-year tax planning session

• Ongoing deduction and compliance guidance

• Priority email support

Tier 3 – Premium Advisory

• Quarterly strategy meetings and tax projections

• Comprehensive business and personal filing

• Year-round email and message support

• Annual tax blueprint update and review

• Audit-prepared recordkeeping guidance

Flexible and Transparent Pricing

Discover our tiered tax advisory plans designed to fit your business needs and maximize your tax savings.

$1,800 – $2,500/yr

($150-$208/mth)

Essential Advisory

Best for: Established business owners who want structure, clarity, and professional preparation with proactive check-ins.

$3,000 – $4,200/yr

($250-$350/mth)

Growth Advisory

Best for: Growing businesses with fluctuating income or expanding teams.

$5,000 – $6,500/yr

($416 – $541/mth)

Premium Advisory

Best for: Established businesses wanting fully integrated tax planning throughout the year.

How We Do It

Learn how Profit Edge Tax Advisory guides you through clear steps to optimize your tax strategy and maximize savings.

Review & Baseline

We start with your prior returns and financials to identify missed deductions, structure opportunities, and key tax efficiency gaps.

Strategic Tax Blueprint

We design your personalized roadmap — your Tax Savings Blueprint — showing exactly where and how to reduce taxes based on your unique numbers.

Regular Reviews

Depending on your plan, we meet semiannually or quarterly to update projections, monitor income, and make adjustments before deadlines hit.

Filing

We prepare and file your business and personal returns in sync with your tax strategy — eliminating surprises and last-minute stress.

Year-End Wrap & Reset

After filing, we review results and reset the plan for the next year — building continuous improvement into your tax process.

Getting Started

Learn how Profit Edge Tax Advisory guides you through clear steps to optimize your tax strategy and maximize savings.

Step One: After signing up, Schedule Your Intro Call

A short discovery session to discuss your goals and challenges.

Step Two: Receive Your Tax Efficiency Assessment

We review your tax returns and financials for potential savings.

Step Three: Build Your Tax Savings Blueprint

Your personalized plan for structured, ongoing tax efficiency.

Step Four: Implement and Review

Semiannual or quarterly check-ins keep your plan current and effective.

FAQ

Why was the Profit Edge Tax Advisory Service created?

The Profit Edge Tax Advisory Service was built to help small business owners stop reacting to taxes and start managing them proactively with structure and confidence.

What is the difference between tax filing and tax planning?

Tax filing is backward-looking, focusing on past taxes, while tax planning is forward-thinking, aiming to optimize taxes proactively for future success.

What are the tiers of the Profit Edge Tax Advisory Service?

The service includes four tiers: Essential Advisory, Growth Advisory, Premium Advisory, and a comprehensive process that guides clients through review, planning, and implementation.

How does the tiered pricing work?

Pricing varies based on the chosen tier, ranging from $1,800 to $6,500 annually, with each tier offering different levels of support and services tailored to business needs.

What is the typical process for working with Profit Edge Tax Advisory?

The process involves scheduling an introductory call, receiving a tax efficiency assessment, building a personalized tax savings blueprint, and implementing and reviewing the plan with regular check-ins.